The New Frontier for Fraud and Its Prevention

As AI transforms finance, fraudsters are leveraging advanced technologies to perpetrate sophisticated scams. Learn how the industry is fighting back with AI-powered fraud detection solutions.

The finance industry is undergoing a seismic transformation fueled by the rise of artificial intelligence (AI), with several operational use cases enhancing efficiency and customer satisfaction. Businesses are currently implementing AI technologies in areas such as personalized lending & insurance options, automated risk assessment, AI-powered customer service chatbots and predictive analysis.

However, as the industry embraces these advancements, fraudsters are also leveraging AI to exploit vulnerabilities.

The Growing Threat of AI-Driven Fraud

Finance and insurance fraud has long been a costly issue, but the rise of AI has magnified its complexity and scale. Recent statistics underscore the magnitude of the problem:

- Deepfakes in Banking: Deloitte's Center for Financial Services predicts that gen AI could enable fraud losses to reach US$40 billion in the United States by 2027, from US$12.3 billion in 2023, a compound annual growth rate of 32%. (Deloitte Financial Services Predictions)

- Annual Financial Impact: In the United States alone, insurance fraud costs companies approximately $308.6 billion annually. (Insurance Fraud)

- Fraud Prevalence: According to Forbes, an estimated 20% of insurance claims are fraudulent. (Forbes)

- Rising Fraudulent Claims: Research reveals that 94% of claims handlers suspect that at least 5% of insurance claims are being manipulated with AI. Lower-value claims are particularly vulnerable to manipulation. (Browne Jacobson)

AI-driven fraud tactics, such as the creation of synthetic identities, the use of deepfakes, and data manipulation, are rapidly outpacing traditional fraud detection systems, leaving providers vulnerable to more sophisticated and harder-to-detect attacks.

complexity of AI-driven fraud

From Deepfakes to Manipulated Images: The Threat Is Real

As practice shows, AI-driven fraud cases are already occurring today. From manipulating images to fabricating medical evidence, these examples show how AI is enabling more deceptive and difficult-to-detect fraud schemes:

-

Image and Document Manipulation: At Zurich Insurance Group's UK offices, a claimant submitted a photo of a damaged vehicle as evidence. Investigators discovered the image had been altered using AI, with the original photo copied from a salvage yard's website and manipulated to support a false claim. (Zurich Insurance Magazine)

-

Deepfake Technology: In January 2024, fraudsters used deepfake technology to impersonate a Hong Kong firm's CFO and colleagues on a video call, convincing an employee to transfer $25 million. The employee, believing the call was genuine, sent the funds to the scammers, highlighting the growing threat of AI-driven fraud. (Deloitte)

Scott Clayton, the head of claims fraud at Zurich Insurance Group, notes that while shallowfakes (manually edited images) are more common today, deepfakes are rapidly emerging as a major challenge. (Business Insider)

-

Mass-Scale Fraud Operations: AI allows fraudsters to operate at an unprecedented scale, submitting hundreds of forged claims supported by fake images, documents, and narratives. This amplification of fraudulent activities poses a severe threat to current detection capabilities. (Business Insider)

Why Legacy Systems Fall Short

Traditional fraud detection systems, reliant on manual processes, rules-based engines, and statistical models, are ill-equipped to handle the increasing complexity of AI-driven fraud. These systems use predefined rules to flag suspicious claims, but they are static and unable to adapt to emerging threats like deepfakes or synthetic identities. As a result, fraudsters can easily bypass detection.

Moreover, manual investigations are time-consuming, making it difficult to handle the high volume of claims and frauds operating at scale. This leads to delays in detecting fraud. While traditional systems often result in high false positives, AI-based systems can significantly reduce unnecessary investigations and operational costs.

For businesses to effectively combat AI-driven fraud, transitioning to more advanced and adaptive systems is essential.

Enter DeepXL.ai: A Solution for Modern Challenges

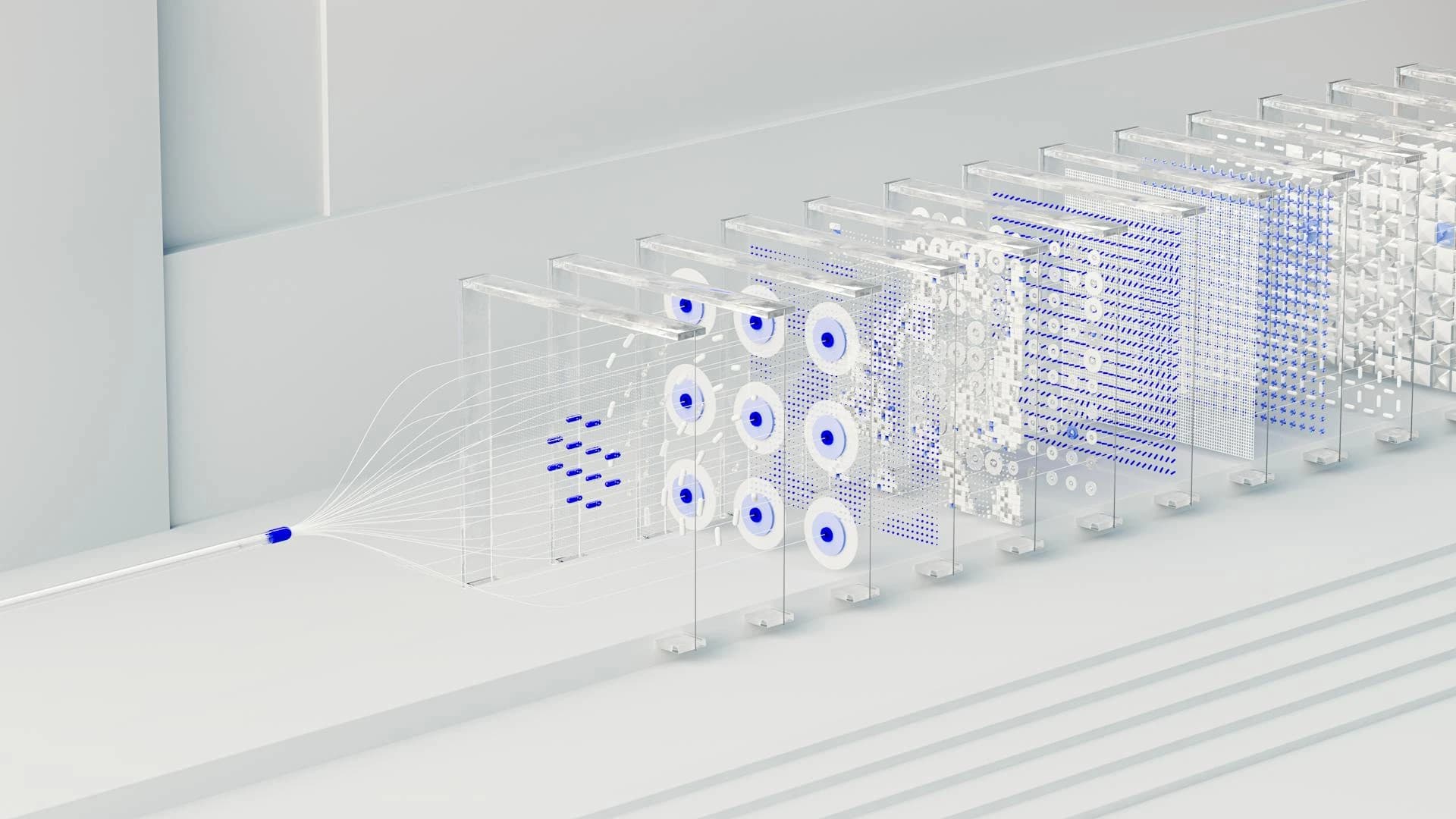

DeepXL.ai is leading the charge against AI-driven finance & insurance fraud. Its cutting-edge platform is specifically designed to detect and prevent fraud with unprecedented accuracy and efficiency.

Key features include:

- Advanced Evidence Analysis: Achieves 98% accuracy in detecting manipulations in photos and documents, ensuring claims are processed with precision.

- Transparent Investigation: Intuitive heatmaps highlight manipulated areas, providing clear visual evidence that strengthens your fraud prevention efforts. DeepXL.ai provides insurers with detailed forensic analysis visualization and advanced metadata extraction and tampering detection, ensuring verifiable and explainable solutions to combat AI-driven fraud.

- FraudIQ™ Network Defense: Leverages collective intelligence across providers to identify emerging fraud patterns and preempt fraudulent activities.

- Seamless Claims Integration: Deploy the API-first solution within your existing workflow in just one day, offering immediate ROI with minimal disruption to your operations.

Why Investing in AI Fraud Solutions Is Crucial

The fraud detection market is projected to significantly grow, showcasing AI's critical role in combating fraud. The insurance fraud detection market alone is expected to grow from $5.7 billion in 2024 to $32.2 billion by 2032. (Insurance Fraud Detection Market Report)

The financial stakes for providers are enormous. Fraud not only affects profitability but also undermines customer trust. Adopting advanced AI solutions can lead to a significant reduction in fraudulent claims, as well as considerable savings in investigation costs. And of course, detecting fraud cases translates into millions of dollars in savings annually!

Ready to safeguard your business against the growing threat of AI-driven fraud? Start a conversation with DeepXL.ai today.