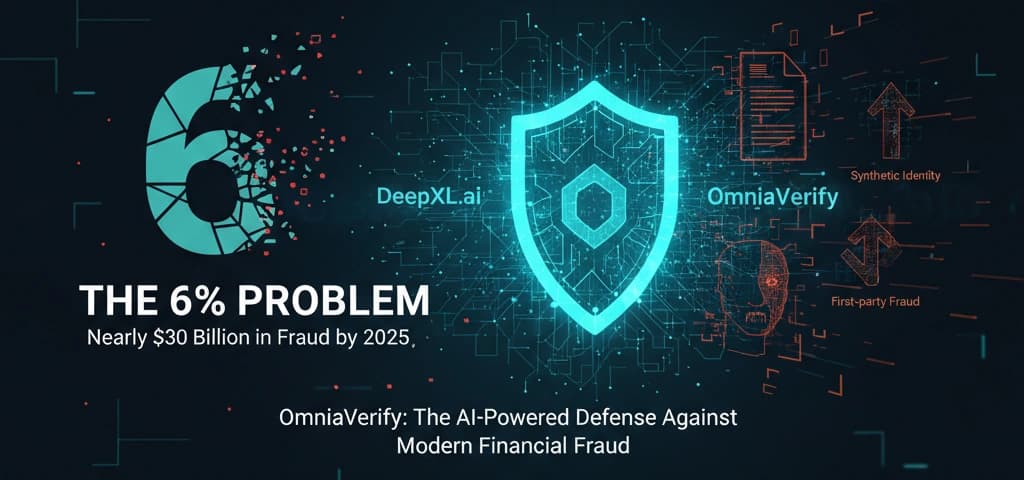

The 6% Problem: Why U.S. Unsecured Lending Needs a New Line of Defense

New research reveals 6% of unsecured loan applications contain fraud, with document manipulation at 6.64% and ID fraud at 5.02%. Here's how AI-powered detection delivers 11x ROI while protecting the $5 trillion lending market.

The 6% Problem: Why U.S. Unsecured Lending Needs a New Line of Defense

The U.S. unsecured lending market is in the midst of a profound transformation. With $5 trillion in outstanding consumer credit and over 60% of personal loans now processed through digital channels, the industry has never been more efficient—or more vulnerable.

Our comprehensive analysis of real-world loan applications reveals a stark reality:

6% of unsecured loan applications contain fraud, with document manipulation reaching 6.64% and ID fraud at 5.02%. For lenders processing 200,000 applications annually, this translates to $30 million at risk.

But here's the breakthrough: Advanced AI detection doesn't just stop fraud—it delivers 11x ROI while transforming operational efficiency.

The Hidden Crisis in Digital Lending

The shift to digital-first lending has created unprecedented opportunities for fraudsters. As lenders increasingly rely on automated processes to meet consumer expectations for fast, frictionless credit access, they're simultaneously contending with sophisticated criminals exploiting these same digital channels.

The Numbers Tell the Story

Our multi-year analysis of U.S. unsecured lending applications uncovered alarming trends:

Key Findings from DeepXL's Research:

- Overall fraud rate: 5.99% of all applications

- Document fraud: 6.64% of submitted documents contain manipulation

- ID fraud: 5.02% of identification documents are altered or synthetic

- Detection delay: Most fraud discovered weeks or months after disbursement

The bottom line: Industry estimates suggest fraud and charge-offs can account for up to 15% of total losses in unsecured lending portfolios—making prevention not just smart business, but essential for survival.

The Generative AI Acceleration

The advent of generative AI has fundamentally changed the fraud landscape. Today's fraudsters use AI tools to create highly realistic fake documents in seconds—pay stubs, bank statements, utility bills, even government-issued IDs. These documents can be generated or altered for less than the cost of a coffee, making sophisticated fraud accessible to virtually anyone.

Traditional rule-based detection systems, designed for simpler threats, are being overwhelmed by the volume and sophistication of AI-generated fraud attempts. Manual review processes, once the industry's last line of defense, are now inadequate against threats that evolve faster than human reviewers can adapt.

Real-World Impact: A Case Study in Scale

Consider a mid-sized lender processing 200,000 unsecured loan applications annually with an average loan size of $2,500:

The Business Case for Action:

- Fraud exposure: $30 million at risk based on observed fraud rates

- Manual review burden: Thousands of applications requiring costly human investigation

- Customer experience: Legitimate borrowers face delays while fraud investigations slow the pipeline

- Operational costs: Significant resources diverted from growth to fraud management

The financial impact extends beyond immediate losses. Lenders face reputational damage, regulatory scrutiny, and competitive disadvantage as fraud undermines their ability to serve legitimate customers efficiently.

The DeepXL Solution: AI That Delivers Results

Our AI-powered fraud detection platform addresses these challenges head-on with measurable results:

Advanced Detection Capabilities

DeepXL's multi-layered AI models detect fraud tactics from simple document forgery to complex synthetic identity schemes. The platform continuously learns from new data, adapting to emerging threats and maintaining high accuracy levels—critical in a landscape where fraud tactics evolve rapidly.

Operational Transformation

By automating pre-review of submitted documentation and flagging high-risk applications for focused scrutiny, DeepXL enables lenders to:

- Streamline workflows and reduce manual review burden

- Accelerate approvals for legitimate borrowers

- Focus human expertise on complex cases requiring judgment

- Maintain competitive advantage through superior customer experience

Measurable ROI

Proven Results for Lenders:

- 11x return on investment for lenders processing 200K+ loans annually

- Reduced fraud losses through early detection

- Lower operational costs via automation

- Enhanced customer experience through faster processing

The Technical Advantage

Comprehensive Document Analysis

Our AI examines every aspect of submitted documents:

- Metadata forensics to detect hidden edits and tampering

- Visual analysis to spot AI-generated or manipulated content

- Pattern recognition to identify reused or template-based fraud

- Cross-referencing to catch duplicate documents across applications

Identity Verification Excellence

For ID documents, our platform provides:

- Security feature validation for watermarks, holograms, and embedded elements

- Typography analysis to detect altered text and fonts

- Photo integrity checks to spot synthetic or manipulated images

- Template matching against authentic document formats

Real-Time Risk Scoring

Every application receives clear, actionable risk assessment:

- Trusted: Safe for automated approval

- Warning: Requires focused human review

- High Risk: Likely fraudulent, requires investigation

Industry Implications and Call to Action

The unsecured lending industry stands at a crossroads. The rapid evolution of digital fraud, particularly synthetic identity and AI-driven document manipulation, demands a new approach to risk management.

The Urgency Factor: 75% of businesses report that fraud is rising or remaining at concerning levels, making the need for action urgent.

Lenders that fail to adapt face not only financial losses but also reputational damage and regulatory scrutiny. As fraud tactics become more sophisticated and accessible through AI tools, the window for implementing effective defenses is narrowing.

The institutions that act now—investing in advanced AI infrastructure and seamless integration capabilities—will be the ones that thrive in an increasingly digital future.

The Path Forward

The data is clear: fraud is not just a cost of doing business in unsecured lending—it's a threat to the industry's foundation. But with the right AI-powered tools, lenders can turn fraud defense into competitive advantage.

Industry Reality Check: With 75% of businesses reporting rising fraud levels and potential losses reaching $40B by 2027, the question isn't whether to invest in advanced fraud prevention—it's whether you can afford not to.

DeepXL's research confirms what forward-thinking financial institutions already know: the future belongs to those who can effectively balance speed, security, and customer experience.

The time to strengthen your fraud defenses is now—before your losses escalate further.

Sources & Methodology

This analysis is based on DeepXL's comprehensive review of real-world loan applications from U.S. unsecured lenders, utilizing authoritative data from:

- Federal Trade Commission (FTC) - Consumer Sentinel Network Data Book 2024

- TransUnion - 2023 Global Digital Fraud Trends Report

- LexisNexis Risk Solutions - True Cost of Fraud Study 2024

- U.S. Treasury - FinCEN Advisory on Synthetic Identity Fraud

- Federal Reserve - Consumer Credit Report G.19

Frequently Asked Questions

What is the actual fraud rate in U.S. unsecured lending? DeepXL's analysis of real-world loan applications found a 6% overall fraud rate, with 6.64% of documents containing manipulation and 5.02% of ID documents being altered or synthetic.

How much does fraud cost lenders annually? For a mid-sized lender processing 200,000 applications yearly at $2,500 average loan size, fraud exposure reaches $30 million annually. Industry-wide, fraud and charge-offs can account for up to 15% of total portfolio losses.

What ROI can lenders expect from AI fraud detection? DeepXL's platform delivers approximately 11x ROI through reduced fraud losses, lower operational costs, and enhanced customer experience via faster processing of legitimate applications.

How quickly can AI detect document fraud? DeepXL's AI analyzes documents in real-time, providing instant risk classification (Trusted, Warning, High Risk) with explainable evidence and confidence scores.

Ready to see how AI-powered fraud detection can protect your loan portfolio?

Book a consultation to discuss your specific needs and see DeepXL in action, or explore our demo to see the technology at work.